According to Rainbow Restoration, water damage is a significant concern for homeowners and businesses, with these far-reaching impacts.

|

From minor leaks to catastrophic floods, water damage can set in quickly and cause significant financial loss.

Water damage statistics such as frequency of property loss, average insurance payouts, and common causes provide insight that is useful when preparing for a potential water event. This article also covers prevention tips and when to call in the professionals for water damage restoration.

|

Key Water Damage Facts:

|

|

Methodology: This article compiles data from several water damage sources, including the Federal Emergency Management Agency (FEMA), the Insurance Information Institute (III), and the Environmental Protection Agency (EPA). Data was collected from these sources to provide accurate and up-to-date information on water damage facts, flood damage statistics, and insurance claim trends. Additionally, relevant statistics were gathered to illustrate the prevalence and impact of water damage in residential and commercial settings. |

Table of contents:

- General Water Damage Statistics

- Water Damage Claims Statistics

- Flood Damage Statistics

- Types of Water Damage

- Most Common Causes of Water Damage

- Tips for Navigating Water Damage

- Trust Rainbow Restoration® for Water Damage Restoration

- FAQ About Water Damage Statistics

General Water Damage Statistics

Water damage is a serious threat to any property and can occur due to floods, leaks, and burst pipes. The consequences can be far-reaching, from structural damage to mold growth.

- Southern homeowners (48%) and renters (39%) are more likely to have experienced water and severe wind damage than other regions. (Chubb)

- Water damage affected 44% of U.S. homeowners in 2022, compared to only 27% in 2020. (Chubb)

- Water causes 45% of all interior property damage, surpassing fire and burglary. (Chubb)

- Over a quarter (26%) of U.S. homeowners know someone who has experienced water damage. (Chubb)

- Over half of homeowners believe thunderstorms, including consequent flooding and tornadoes, are the most likely natural disaster to cause property damage. (III)

- One inch of water in the home can cause $25,000 of damage. (FEMA)

Water Damage Claims Statistics

While many property owners believe their insurance policies will fully cover water damage, the reality is more complex. Understanding the nuances of insurance coverage and how many water damage claims are made each year can help ensure properties are protected.

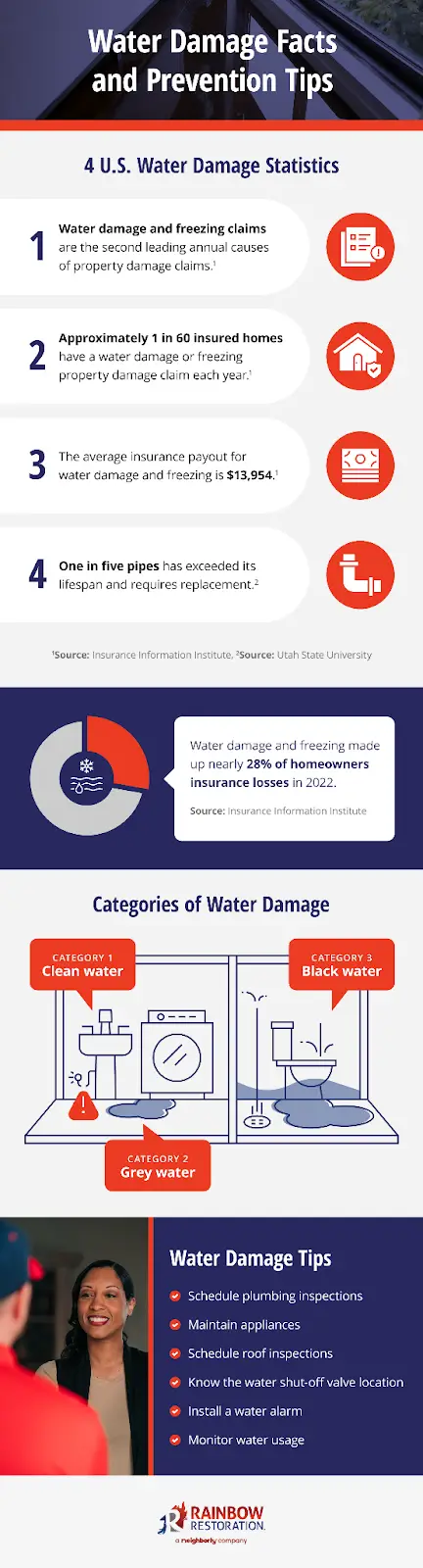

- Approximately 1 in 60 insured homes have a water damage or freezing property damage claim each year. (III)

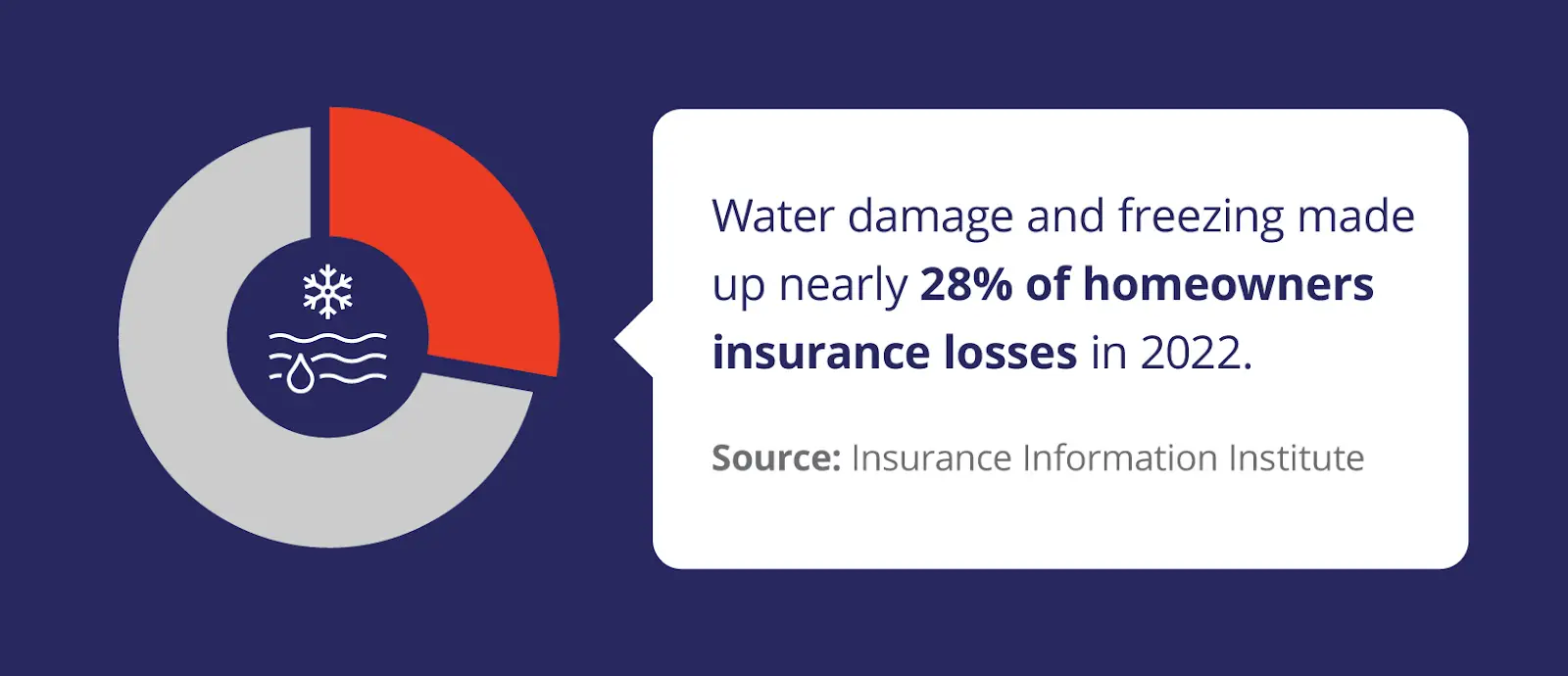

- Water damage and freezing made up nearly 28% of homeowners insurance losses in 2022. (III)

- The average insurance payout for water damage and freezing is $13,954. (III)

- Water damage and freezing claims are the second leading annual causes of property damage claims, behind only wind and hail. (III)

- Of the 5.8% of insured homes that had a claim between 2018 and 2022, 1.6% were from water damage and freezing causes. (III)

Flood Damage Statistics

From minor basement floods to catastrophic natural disasters, flooding can cause significant property damage and financial loss. Awareness of flood facts and how much damage a flood can cause, are crucial for property and business owners alike.

- More than 1 in 5 homeowners believe they’re susceptible to flooding. (III)

- Nearly 1 in 7 homeowners are uncertain about their flood risk. (III)

- Mistakenly, 85% of companies think their property insurance covers some to all kinds of flooding. (Chubb)

- Roughly 40% of National Flood Insurance Program (NFIP) claims aren’t made in high-risk flood areas. (FEMA)

- Flood damage isn’t usually covered under homeowners or renters insurance policies. (FEMA)

- Mortgage lenders require flood insurance for federally backed mortgages in high-risk areas. (FEMA)

- Every U.S. state has experienced floods or flash floods in the last five years. (FEMA)

- Over the past five years, the average flood insurance claim payment was approximately $69,000. (FEMA)

Types of Water Damage

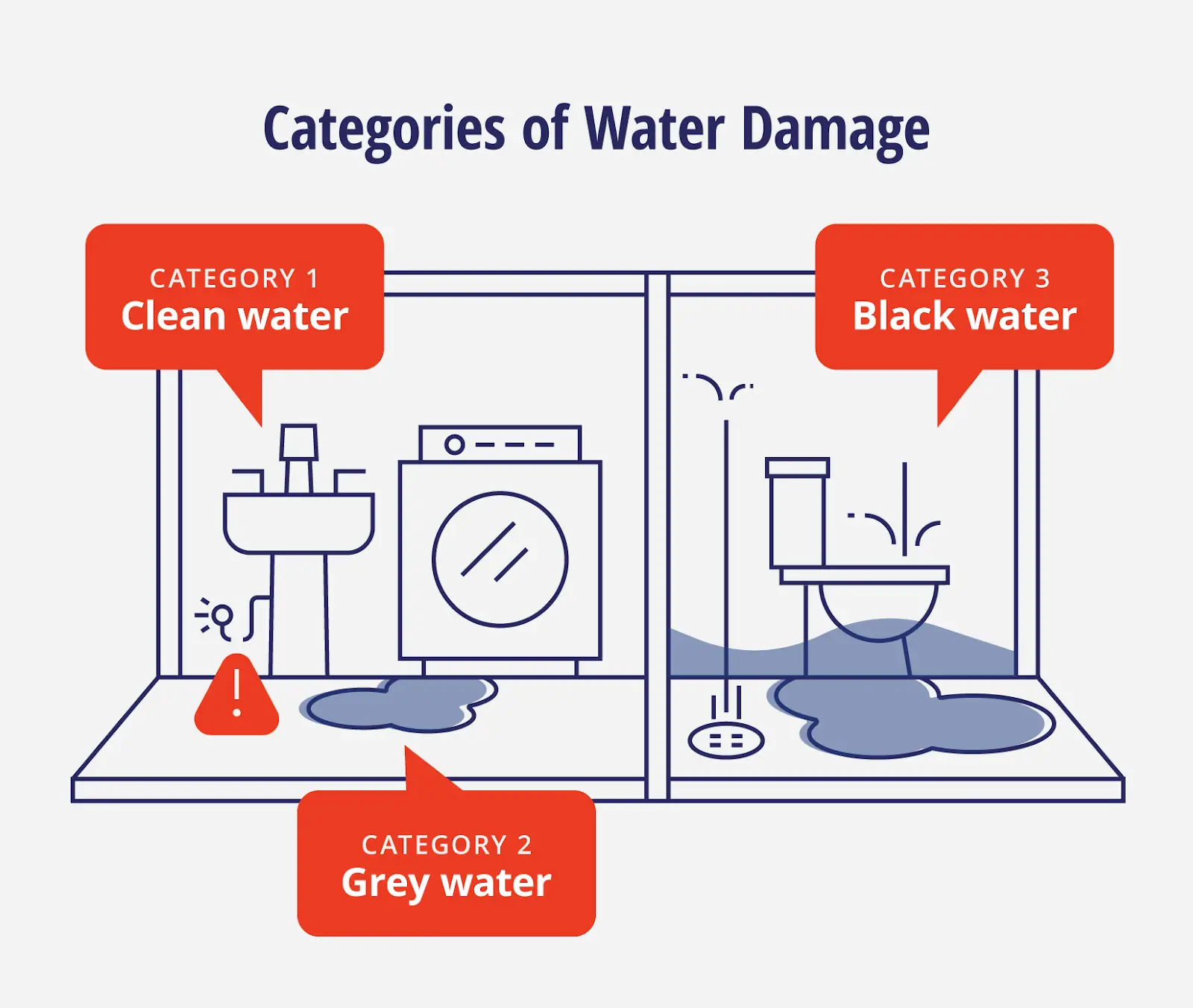

There are three types of water damage based on the source and level of contamination:

- Category 1 - Clean water: This type of water damage originates from sanitary sources like broken supply lines. It poses slight health risks.

- Category 2 - Grey water: This category contains moderate levels of contamination and causes discomfort or illness if ingested. An appliance leak like dishwasher flooding is a common source.

- Category 3 - Black water: This type is heavily contaminated with pathogens and fecal matter, posing serious health risks. Sewage backups or flooding from rivers or oceans are frequent examples.

- Category 1 and 2 water damage may be covered by homeowners' insurance, while category 3 water damage requires flood insurance coverage.

Most Common Causes of Water Damage

Beyond flooding from natural disasters, pipe failures, faulty appliances, and roof leaks are all common causes of water damage. Preparing for these common causes can help property owners take proactive steps to prevent water damage.

- Over a quarter of a million pipes fail annually. (USU)

- For every 100 miles, a little over 11 pipes break. (USU)

- One in five pipes has exceeded its lifespan and requires replacement. (USU)

- Worn toilet flappers and leaking faucets and other valves are the most common leaks found in houses. (EPA)

- A family of four using more than 12,000 gallons of water a month is a sign of significant leaks. (EPA)

- Nearly 10,000 gallons of water are wasted annually by the average household due to leaks. (EPA)

- Over half of U.S. homeowners installed a water shut-off device after they or a friend had a leak. (Chubb)

Tips for Navigating Water Damage

Water damage can be devastating. Taking proactive steps and knowing what to do in an emergency can help minimize its impact.

- Schedule plumbing inspections: To identify and address issues early on, have a plumber check for leaks in faucets, pipes, and toilets.

- Maintain appliances: Schedule regular maintenance of major appliances such as washing machines, dishwashers, and water heaters to check for leaks and replace worn parts.

- Schedule roof inspections: Have professionals check for missing shingles, cracks, or loose flashing. Hire a professional to clean gutters and downspouts to prevent water buildup.

- Know the water shut-off valve location: Make sure everyone on the property knows where the main water shut-off valve is located and how to use it in case of a water emergency.

- Install a water alarm: Consider installing water alarms in areas prone to leaks, such as basements, laundry rooms, and near water heaters. These alarms can detect leaks early on and prevent further damage.

- Monitor water usage: Monitor water bills for unusual spikes in water usage. Overconsumption can be a sign of a leak.

Trust Rainbow Restoration for Water Damage Restoration

These water damage statistics highlight the importance of prevention and professional restoration, from the impact water damage can have on a property to proactive steps that can be taken to help protect investments.

If water damage occurs, trust a water damage restoration specialist to mitigate damage and expedite the recovery process.

This article is intended for general informational purposes only and may not be applicable to every situation. You are responsible for determining the proper course of action for your home and property. Rainbow Restoration is not responsible for any damages that occur as a result of this blog content or your actions. For the most accurate guidance, contact the Rainbow Restoration location nearest you for a comprehensive, on-site assessment.

FAQ About Water Damage Statistics

Setting the highest standards in water, fire, and mold damage restoration requires a continuous focus and dedication to education and improvement. This commitment to exceptional service also includes using our years of experience and expertise to answer your restoration questions.

Here are answers to some of the most frequently asked questions about water damage statistics.

What is the biggest concern with water damage?

The most significant concern with water damage is the potential for mold growth. Mold can cause serious health problems, including respiratory issues and allergies.

Does homeowners' insurance cover flooding damage?

No, standard homeowners' insurance typically doesn’t cover flood damage. Separate flood insurance policies are required to protect against flood damage, especially for those living in flood-prone areas.

What is the most common cause of water damage?

Leaky pipes are one of the most common causes of water damage. They can corrode over time, leading to water damage in walls, ceilings, and floors.